Plumber Repair Costs Near Columbus, OH

25C Tax Credit—Eco-friendly Home Upgrades

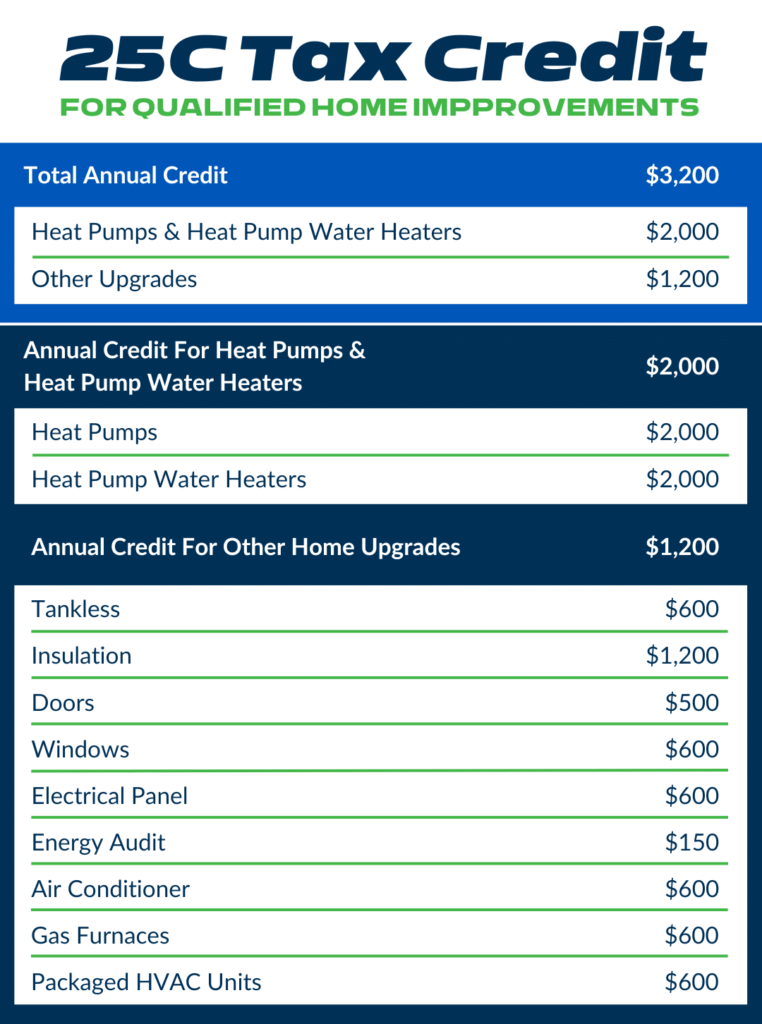

Energy Efficient Home Improvement Credit—25C Tax Credit

What is the 25C Tax Credit?

On August 16, 2022, the U.S. government enacted the Inflation Reduction Act (IRA) to slash greenhouse gas emissions by 40% by 2030. A key aspect affecting Plumbing, Electrical, and HVAC is the Energy Efficient Home Improvement Tax Credit (25C), which offers cost-saving options for purchasing energy-efficient appliances or making home improvements to enhance energy efficiency or electrify homes. The 25C, initially introduced in 2005 under the Energy Policy Act, evolved to its most rewarding form in 2022 with the IRA, providing improved tax incentives for eco-friendly home and business solutions by targeting carbon emissions.

What is eligible for the Tax Credit?

Eco Plumbers, Electricians, and HVAC Technicians will come through for you when you need us to with Eco-friendly options!

Is there a lifetime limit on the credits?

The credit has no lifetime dollar limit. You can claim the maximum annual credit every year that you make eligible improvements until 2033. Read more about the Energy Efficient Home Improvement Credit

How does a homeowner receive the 25C tax credit?

Need to set up an appointment with us?

Homeowners who have purchased and installed qualifying equipment can claim the tax credit when filing their taxes with the IRS using the Residential Energy Credits tax form (form 5695)

Eco Plumbers, Electricians, and HVAC Technicians is not a licensed tax professional and cannot provide tax advice. Consult your tax advisor regarding your eligibility for any tax credits.

Need to set up an appointment with us?

Serving Columbus And Central Ohio

- Amlin

- Ashley

- Bexley

- Blacklick

- Brice

- Canal Winchester

- Cardington

- Centerburg

- Circleville

- Columbus

- Croton

- Delaware

- Dublin

- Galena

- Galloway

- Grove City

- Groveport

- Harrisburg

- Hilliard

- Johnstown

- Kilbourne

- Lancaster

- Lewis Center

- Lithopolis

- Lockbourne

- Logan

- London

- Marengo

- Marion

- Marysville

- New Albany

- Ostrander

- Pataskala

- Pickerington

- Plain City

- Powell

- Prospect

- Radnor

- Raymond

- Reynoldsburg

- Richwood

- Sunbury

- Waldo

- West Jefferson

- Westerville

- Worthington

- View More Areas